January 21, 2005

Social Security For Dummies

I have been creating some "Social Security For Dummies" graphs that anyone is welcome to use.

Update: This can now also be passed around in pamphlet form. Print out and assemble multiple copies and leave them in local coffee shops or community centers. Download here, mirror here.

Social Security For Dummies

Social Security is funded by a payroll tax. When we make wages, 6.2% is taken out of our paychecks to go to Social Security. An additional 6.2% is matched by our employers. This stops after the first 90k of income for each person.

In a perfect year, the Social Security beneficiaries would need exactly as much money as we pay in taxes. However, most of the time, the amounts are unequal. When the baby boomers retire, they will require more money than the payroll tax generates.

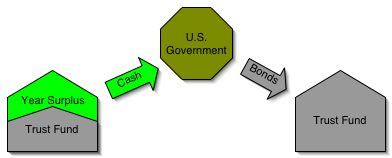

To make up for this, we have years where we generate more in payroll taxes than we need to spend on beneficiaries. This excess goes into a Trust Fund. The Trust Fund grows each time there is a yearly surplus.

Later, when there are years where the beneficiaries require more money than the payroll taxes provide, we can take money from the Trust Fund to make up the difference.

Since 1970, there have been 11 different years where we have had to do that, and it's worked fine.

How does the Trust Fund work? When excess money is generated, Social Security is required by law to invest the money in U.S. Treasury Bonds, considered the safest investment on the planet. They are issued by the U.S. Government, who has never defaulted on them. These bonds are supposed to be cashed in later when extra money is needed.

So, Social Security's Trust Fund is a big collection of bonds, and the U.S. Government gets the cash.

What does the Government do with this money? It spends it. That is theoretically okay if the intention is to pay it back later, but that is not Bush's intention.

In 2003, the Bush Administration ran a deficit of $536 billion. Social Security ran a surplus of $156 billion. (The Postal Service also ran a surplus of $5 billion.) So, the Bush Administration reported a deficit of $380 billion instead of $536 billion, ignoring the fact that that money is supposed to be earmarked for future bond redemptions.

Now the Bush Administration is saying that when beneficiaries require money than payroll taxes generate - 2018 or 2028, depending on who's talking - that we will not be able to afford it.

This basically means that the Bush Administration is following a policy of ignoring the Trust Fund entirely. Rather than viewing excess money as going to the Trust Fund, they view it as going to the government:

And then when the time comes, they will see the extra money that the Beneficiaries needing as coming from the government, from cashing in bonds:

They will then paint this as a problem - even though this is exactly how it is supposed to work - because in their mind, it would require higher government spending. And the GOP can't have that. So instead of paying us back, they say that benefits would instead need to be cut.

It is important to recognize what they are doing here. The payroll tax is a regressive tax designed for Social Security. Normal tax is a progressive tax designed for normal government spending. They are two separate systems. Revenue and Spending need to balance out in each system, and they should not intermingle:

But the Bush administration applies payroll tax to the normal deficit, claims that the trust fund does not exist, says Social Security needs to be cut, and implies that the government isn't good for their U.S. Treasury Bonds anymore:

To summarize, the Bush Administration takes the extra payroll taxes intended for Social Security and spends it on war and tax cuts:

Then, Bush declares there isn't money for when the Social Security beneficiaries require more money than the payroll taxes supply, and says the only solution is to cut Social Security benefits:

When actually, the truth is that the surplus is supposed to be applied to social security in later years:

While the following shows what the real problem is, in red, white and blue:

That's rather compelling. But I think you forgot one more graph.

Bush====>Blames His Faults on===>Bill Clinton and/or Saddam Hussein.

Posted by: Euthanasia at January 21, 2005 08:10 AMI think you can get rid of the last four charts, they don't help.

The one liberty you have taken here, and its a pretty key one, is the fiction that this system was somehow invented by Bush. Because it has always been this way. Every dollar of social security surplus has always been a dollar less of budget deficit or a dollar more of budget surplus. It has never gone into any trust fund. Therefore everyone has always been spending the surplus.

Look at the UK - they have exactly the same system we do (plus a privatised version on top, a "Tier 2"). They have no trust fund. So they finance their social security exactly how we do, will face exactly the same budget pressures we do, but they have one advantage - they will never have to talk about this stupid non-existant trust fund!

Posted by: Pepik at January 21, 2005 12:37 PMClinton didn't. He worked on paying down the deficit. In the final year of his administration, he had a budgetary surplus that didn't even count the social security surplus.

Just because there's been a common problem doesn't mean it should be accepted to the point that it doesn't become a problem anymore. I've made that point to you before, Pepik.

Nicely done, Musey. I have some people that could learn a lot from that.

Posted by: Tommy at January 21, 2005 06:36 PMThese graphs show...

how we can make SS a Strategic Initiative, as Lakoff would say. We can win on the SS issue while also getting people to notice how the deficit is a major problem. If we win on SS then we tell people that the SS issue is not over until the deficits are gone and the budget balanced because Republicans still have another plan for dismantling SS by breaking the fourteenth amnedment and just simply stating that they can't or won't pay for it. If the budget isn't balanced and the deficits reduced then the Republcians will continue to run deficits that will do permanent damage to SS. Strategic Initiative! Run on SS, deficits, and balancing the budget.

This comment is both ridiculous and insightful.

"To summarize, the Bush Administration takes the extra payroll taxes intended for Social Security and spends it on war and tax cuts"

First of all, you can't select the government spending you disagree with and call that the money intended for something else. I could just as easily say that the money we waste on funding the arts is the cause of the social security problem. While I disagree with the level of spending this president is doing, it is generally the Democrats who have the spending problems because they are beholden to misguided Keynesian economics and the idea that government knows how to spend money better than the people who earn it. The Clinton administration would have spent at unprecedented levels had the Republicans not gained control of congress and blocked most of his programs -- think Hillary Health Care.

Which leads me to the insightful section of the above quote. "spends it on... tax cuts" You Democrats can't seem to understand that it is not the Government's money, and cutting taxes is NOT spending. It is TAKING LESS from the people who earned it.

Which brings up another point. What in the world is wrong with giving people the CHOICE to place some of their money in a private account? Why are you against this? It does not deplete the funds of anyone who wants to stay in, but it does provide far greater returns for those who want to partially privitize. Aditionally, it pumps more money into the economy (which drives growth and jobs) and out of the hands of government.

Ty, you miss the point. The problem is that the Bush Administration is spending the surplus, and then claiming that the resultant Social Security deficit is Social Security's fault.

It's not cutting SS's benefits that is the solution; it's either raising our normal progressive tax rate or cutting other government spending.

401k's and IRA's are fine, but cutting social security isn't.

I do not miss the point. There is no surplus (not just because of Bush), and privitization does not "cut" benefits.

The "Social Security Trust Fund" is fictional by normal accounting standards. The Social Security system gets government bonds in exchange for the Social Security tax money that is being spent today instead of being saved. But you cannot spend and save the same money, no matter what accounting gimmicks you use.

Government bonds are not an investment that adds to the country's wealth. They are a claim on future taxpayers. Without those bonds, future taxpayers would still be on the hook to provide the money to cover future Social Security pensions that are not covered by future Social Security taxes. The bonds change nothing.

Clinton and Gore, in the early 90's, were the first ones to publically confront the future insolventacy of social security. One of their ideas was partial privitization.

So again I ask, why are you opposed to people keeping more of the money they earn rather than turning it over to the government?

Ty, you're being deliberately stupid. Privatizing costs money, and the Bush Administration is proposing social security cuts to pay for it.

The surplus money was designed to offset future social security deficits. That's what the whole 1980s revision was about. It's fine for the government to borrow/spend it in the meantime, but they have to pay it back. You can't borrow money from a billpayer, refuse to pay them back, and then tell them their resultant debt is their fault. If SS Surplus money goes to the general fund, then SS Deficit money needs to come from the general fund. If you want to cut SS benefits, then argue for cutting the payroll tax.

Quit trying to deliberately confuse the issue.

Your last question is basically asking me why I'm in support of Social Security. That question doesn't exactly put me on the defensive.

Ease up on the name calling tunesmith. This is not personal.

The big picture is that I fundamentally disagree with the notion that government knows how to save for my future better than I do. And the fact that it is illegal not to participate in this ponzi scheme called Social Security is especially galling.

I know what the Government is SUPPOSED to do with surpluses regarding SS, but no administration has, nor will. That's the point. The ability to pay back gets increasingly difficult.

I realize there will be transition costs because we connot penalize current beneficiaries or penalize those who want to remain 100% in the system, but we have an opportunity here to do the right thing.

Voluntary personal accounts will allow competing fund managers, rather than the government, to allocate a large pool of money. Personal accounts will respect individuals' autonomy and competence, and will narrow the wealth gap by facilitating the accumulation of wealth by persons of modest incomes.

Not trying to put you on the defensive. I truly want to know why Democrats are opposed to privitization...since that is the main question.

My suspicion why is extremely cynical: 1) Democrats do not think people are smart enough to handle their own money 2)it's an old person vote buying scheme.

I do not understand why non-politicans would not want the choice...or at least allow others to have it.

Ponzi schemes or pyramid schemes are so named because the pyramids are finite and they eventually run out of supply; the pyramids crumble. Social security is not a pyramid scheme because generations are infinite. (If we all get wiped out from a meteor, I doubt we'll be gnashing our teeth from being screwed out of our social security benefits.)

As I said, I like retirement accounts like 401k's or IRA's. I'd also be in support of personal retirement accounts outside of the social security system. But it is not an excuse to cut social security. The average social security check is $1150/month. Without social security, somewhere around half of our seniors would be in poverty. That is not money to play around with.

And you call it a vote buying scheme.

I call it a vote buying scheme because there are no cuts. The language the Dems are using is very misleading. It's not being taken away. There still will be social secuity at its expected levels.

We are talking about partial privitization...which it sounds like you'd be in favor of if current recipients didn't get hurt. I don't want to hurt anybody either -- I'm not evil. If you CHOOSE to remain in the system, you get 100% of what you would normally get.

My opting out, partially, forgoes any funds that the government would owe me. (Again, I understand transition costs) My investments generate greater revenue into the system. Greater revenues in the private sector generate greater tax revenues, which in turn can be used to pay other recipients. Supply side econ. It works.

...got to chase a two-year-old. Good talking with you.

---Ty

Posted by: Ty at January 22, 2005 04:30 PMno, I'm not in favor of partial privatization. have fun with your two-year-old, I have some nieces around that age.

Ty, your "opting out" (along with, say, a few million others) causes a problem due to the money being paid by your payroll taxes now not being the benefit money you will draw in the future. The shorfall thus generated would happen now, not in the future. SS is not a "bank account" for our future, we are right now carrying the beneficiaries of today. Changing the system in midstream, as it were, to a "personal account" model, causes a huge gap, as the "goes in" will immediately drop far below the "goes out". Trust fund or no trust fund, the point is that the system was designed for the "us" of today to pay not our future selves but the "them" of today. The trust fund, be it an accounting concept or a physical entity, is simply the difference between the historical payroll tax income for SS and the historical payout of SS. Wherever the money went, the bottom line is that it needs to go back in for times like the near future when payees come close to matching payers (or exceed payers).

Thus the "crisis" is not in SS, it's in the government's general fund.

Posted by: Robert Schumacher at January 23, 2005 09:44 PMI like the pretty pictures!

Posted by: Scaramouche at January 24, 2005 04:51 PMOkay, but what about me, do I have to call myself a trust-fund baby now?

This is a great argument starter, or finisher!!!

Whooopee, there is a transition cost. Are you speaking out against long term solutions because they have transition costs? How brave.

Posted by: Pepik at January 25, 2005 01:39 PMPepik, privatization is not a solution for a social security problem. First, you have to show that there is a social security problem. There isn't. Second, you have to show that privatization solves it. It doesn't.

WHY CAN'T SOCIAL SECURITY PUT THE SURPLUS IN THE BANK WHERE IT WILL DRAW INTERIST INSTEAD OF BUYING BONDS? IF IT IS IN THE BANK THEY HAVE TO GIVE IT BACK. IF THEY BUY BONDS, THE GOVERMENT CAN SPEND IT AND DOES NOT HAVE TO GIVE IT BACK. I HAVE A HARD TIME BELIEVING THAT BONDS ARE THE SAFEST INVESTMENT FROM WHAT I AM HEARING.THE SURPLUS COULD HAVE DRAWED ALOT OF INTEREST AND YOU WOULD STILL HAVE THE PRINCIPAL.

Posted by: P KUELBER at February 2, 2005 02:00 PMOh, please. The authors of that book advocate a national sales tax, dumping the payroll tax entirely, and replacing it with a fully privatized system. That's hardly objective or politically feasible.

By the way, I heard they just came out with a revision of the date that Social Security goes into deficit. It went from 2018 to 2020, in one year. Hmm!

Posted by: tunesmith at February 3, 2005 02:50 AMSocial Security is the justification for us all to be plugged into the Matrix. It's never been anything but a flaming rip off; basic math would show anyone that.

100% of my earnings should be mine to keep spend invest or give away as I see fit.

The politicians see the worthlessness of S.S., they're not on it.

Posted by: Dave at February 4, 2005 07:34 AMDave, if the republicans made your argument, this argument would be over really fast. The republicans would also be permanently damaged as a political party.

There is no Social Security Trust Fund!!!!!!!!!!

There never has been. By law, any surplus in Social Security has to be invested in US Bonds. This money is then SPENT immediately by the governent. PERIOD. So far, there has been 1.5 TRILLION DOLLARS of surplus Social Security that has been put into the general fund and spent by the government.

Some people say that we can start drawing on that 1.5 trillion when the system starts to cost more than it takes in, around 2018. My question is: Where is that money going to come from? There is no money in the trust fund, it is just an IOU, an obligation that the government has. The money to pay the shortfall is going to have to come from TAXES in 2018 and every year thereafter. Or we could cut benefits, or raise the retirement age.

If you really want a sick feeling, think of it this way. Over the years, we have put 1.5 trillion in our "retirement" fund. But instead of keeping it there, we immediately used that money for our everyday living expenses.

Now when we retire, we expect that money to come from somewhere to pay us. That somewhere is our kids and grandkids. WE EXPECT THEM TO PAY US BACK THE MONEY WE ALREADY SPENT ON OURSELVES YEARS AGO!!!!

Yes, we used that money to give ourselves tax breaks, pay for our highways, fight our wars, feed our hungry, and a lot of other worthwhile things and some that were worthless. BUT THE POINT IS, THAT MONEY WAS MEANT FOR OUR RETIREMENT, NOT OUR LIVING EXPENSES. We spent all our retirement money before we even retired . . . and now we want our kids to make it up to us our of their pockets!!!

Posted by: justaguy at February 9, 2005 08:39 PM

I am sick! Justaguy is absolutely right! We spent part of our retirement money "living it up." When we didn't have enough money for everything we wanted, we just went into a defecit. Many years we spent EVEN MORE money than the Social Security Surplus could absorb.

So basically, we spent everything we made, we spent part of our retirement fund, and then we still spent more! Now we want someone else to pay to fix it???????

Posted by: Jerald Holmes at February 9, 2005 09:03 PMYou guys are funny. All writing from the same ip address.

The debt on our children's back is actually that of heightened government spending. The government is making it sounds as if we can afford that spending more than we actually can, and they do that to build enough support so they can remain in office. But it is dishonest. And if we're being bilked out of money by dishonest means, the answer isn't to take our lumps later, it's to expose the folks bilking us by opposing the frivolous choices they are making. The Medicare plan is so much more of a problem than Social Security is, but Bush is the guy responsible for it being so horrible. The tax cuts that went to our richest members of society is not worth the money - that is money that we might not have felt we could spend if not for the surplus.

I'm not in favor of our children bearing the brunt of the paying back of the national debt. I am in favor of it being paid back by the richer folks who got a tax cut they didn't need and that we couldn't afford.

The endless debtate.

I see it pretty black and white and you should too.

The Government has spent this country into a real problem. It is time to pay the piper and that means programs and or taxes will change. ALL will loose because our Government is unaccountable, irresponsible and frankly is not capable of handing the finacial matters it faces.

Spin it anyway you want. The bottom line is the Government has run the business into the ground and if it were a business, it would have closed its doors years ago.

JP

Posted by: JP at February 11, 2005 04:13 PMMy daughter payed in to the 401k. 401k made a bad

investment, my daughter lost thousands of dollars

and there was nothing she could do about it, can

this happen to the 6% the goverment will invest in

401k for you?

JP, I'd basically agree with that. But it's relevant to look at what parts of the government are overspending, who's been advantaging from that overspending, and who's losing out.

If you don't, then it's too easy to get conned into a situation where the government gives too many benefits to the rich, and then "pays the piper" by taking away from the poor.

help me understand why we arnt going to have any money for social security?? wut else do u think is soo imprtant that u have to spend it on something different???

Posted by: MELISSA at February 22, 2005 07:07 AMthanks!

Posted by: hustler at March 12, 2005 03:23 PMfor folks who believe that the Social Security trust fund is a myth - the Bureau of Public Debt, which is part of our government, refers in their FAQ to two Social Security Trust Funds! apparently its existance is not a myth after all

After many years of paying into the Social Security system, I began receiving checks upon retirement, several years ago.

If during my life-time, I had failed to invest a portion of my wages, I would be attempting to live on a Social Security check ,that would barely cover my housing expenses.

It is quite obvious these days, that many Americans are involved in deficit spending. This deficit spending is typical of individuals that practice instant gratification, and are unwilling to set aside funds, for the purchase of a particular item.

With the advent of plastic, individuals have accumulated thousands of dollars of debt, which eventually leads to bankrupsy, in many cases.

If this practice continues until retirement, this individual will end up with only a Social Security check, and no savings or investments to cover his / her monthly expenses.

Whether you invest a portion of your Social Security check now ,or set aside a portion of your payroll check each month, it is imperative that you set aside funds in addition to Social Security, or upon retirement, you might find yourself in a soup line ,looking for a few scraps of food.

Remember: Whomever controls the purse-strings, controls your life.

In closing, having been a Washington insider some years ago, I am well aware of the spending habits of Politicians. I am also aware of the " pork-barrel " funding of pet projects and of special interest groups. Not only the funding of ,but the incredible waste of tax payer dollars.

I am not speaking of the debt incurred in protecting America from terriorists after 9-11, but I am speaking of projects such as the "Big-Dig" in Mass., which is millions of dollars over budget.Then there is the super collider, that lays vacaant, after spending billions of tax payer dollars.

It's time that we stop listening to deceitful dialog by those that would lead us astray, and use some common sense.

Paul M. Anderson Ed.D., Ph.D. ( Ret. )

Posted by: Dr. Paul M. Anderson at April 29, 2005 10:57 AMI did not have much idea about how SSN works. I had a research paper to do and this site helped me lot in getting the correct information and understanding whats going on with SSN.

Thanks!

Risha