January 06, 2005

Social Security Summary

So, here's a bit of Social Security for Dummies. This is a partial reprint of an earlier post, but with more information.

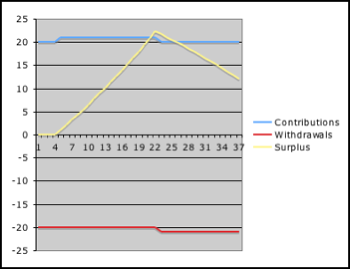

First, a graph of what Bush plans to do with Social Security, with a before and after. A couple of disclaimers about the diagram: "Guaranteed" is a bit absolute, but the social security investments are considered rock-solid. "Stable" and "Unstable" might be better words. Also, a person doesn't have to choose to invest their privatized money in the stock market, but collectively, the people with privatized money will be putting their money in riskier investments.

This diagram is based on estimates of the Bush plan allowing workers to send up to four percentage points of their social security contributions to private accounts. The press coverage has been poor, saying, "four percent of payroll tax" when they really mean four percentage points of the 6.2 percent they send along, like what you see in the graph.

It's not currently known what happens to the employer match, so we'll assume that goes straight to Social Security for now.

Now, why does the Bush Administration say they're doing this? Because of a crisis! Because of an iceberg! Because of an unsustainable course, after which we'll hit an iceberg, which will cause a crisis! I promise, Jack! I'll never let go, Jack! Glug glug!

So, what's the nature of this crisis?

For a while, social security had as much money coming into it (from worker's paychecks) as was going out of it (to seniors). Then, folks got scared about the massive amounts of baby boomers retiring. So, in the 80s we started putting more money into it, so that each year there would be more coming in than going out. That created a surplus over time, at least if you looked at social security as its own separate government account. Later, the baby boomers will retire, and each year there will be more going out than coming in, eating away at the accumulated surplus.

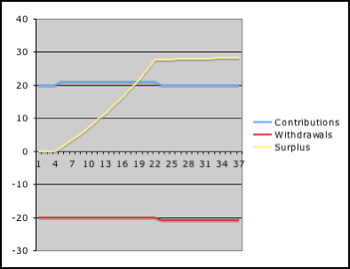

Here's a graph of an analogous situation:

Conceptually, it's the same thing. Say that for a few years, I made 20 bucks and spent twenty bucks. Then for a few years, I made 21 bucks and put the extra buck in a savings account. Then for a few years, I made 20 bucks but spent 21 bucks, and started draining savings. You can see there that the savings account - the surplus - is draining, and I'd eventually be broke.

Now, the wildcard is that when we put money in savings accounts, we get interest. In my above graph, I have the interest set at 2%. Right now, the social security surplus is growing due to our GDP growth, which is conceptually similar to interest, so the surplus degrades slower than it would otherwise.

So what's the iceberg, I mean, crisis? It's that foreboding day when the surplus is eaten away, when the Yellow line goes below 0, and when social security's operating costs become a net drain and start contributing to.... well, the deficit.

Yes, the crisis is that the Bush Administration is trying to avoid a deficit. As if that's ever been a big deal to them before.

Now, here's something funny about when this zero-crossing is supposed to happen. 10 years ago, the projected date was in 2029. Now, the projected date is in 2046. It keeps getting pushed further and further into the future. Why does that happen? It's because they make these projections based off of very conservative growth rates in our economy. But even with the crappy economy of the past few years, we've beaten those projections. What happens if we use more moderate growth projections?

Well, let's go back to my twenty bucks scenario. I mentioned how the graph assumed an interest rate of 2%. What happens if I go up to 4%?

All of a sudden, the interest I make on my savings is enough to account for the yearly imbalance, and I make more money besides.

And that's what happens with social security. If we use more moderate economic growth projections, the surplus will be big enough to pay for the baby boomers, and then some. There would be no crisis at all. None.

It's a delicate balance. A shift of 1% can make the difference between being a millionaire or a pauper in forty years. A shift of 1% can make the difference between social security becoming a dividend to help pay down our national debt, or a drain that contributes to every year's deficit.

Now, about that trust fund. Dirty little secret. It doesn't exist. It's really just all mixed together into a big government checkbook (the "General Fund"), into which come tax revenues, and out of which go government spending, including social security payments. Like we already know, we already have a deficit, a big one. We have a huge national debt. It's a big problem. The Bush Administration's big argument is that a deficit is a big, really bad thing to be avoided at all costs. Are Bush's expenditure choices in line with wanting to pay down the deficit?

While the that chunk of money is going to private accounts, it's still part of the General Fund and doesn't just disappear from the wallets of our seniors. But, it's easy to see how the shift could mean a net reduction in Social Security revenues, or another drain on the deficit. Commission costs. Limited investment choices. Poor stock market performance. You might believe you can beat the market, and I might too, but can we really trust every other Joe Schmoe out there to make good investment decisions? If they don't, the General Fund suffers. There's not a lot of collective upside here overall, and there's a lot more risk.

So, contributions could go down, making the problem worse even as the baby boomers are beginning to retire. Remember the delicate balance. If revenue goes down, then expenditures have to go down too. Here, Bush chooses to decide to push social security expenditures down. There are a few ways to do this - raising the retirement age, or means testing. But what Bush is choosing to do is monkey with the formula that determines how much money we get back, by freezing beneficiaries at a standard of living that does not grow with society's demands - all of us, even the folks that will need it most. We'd pay just as much into it, but we'd get less back.

So you've got a trumped-up crisis that probably doesn't exist at all in basic reality. You've got a private-accounts panacea that probably won't perform as well as the market itself will, and with prospects of matching the status quo that are questionable at best. You've got a government that makes poor economic projections to justify the crisis, but rosy economic projections for the exact same time period to hype the private accounts. And you've got a tax fleecing that takes our social security contributions away from us and gives less of them back than before. All to change a system that already has a good chance of actually helping us to pay down our national debt.

And that skips one major thing - the amount of money it will cost to transition social security to this new system. Most common estimate I've heard? Two Trillion Dollars. A drain on the General Fund, and no plan to pay for it. If you look at it in terms of Social Security (after all, it is the checkbook that best applies), then that drains a big chunk of that baby-boomer-financing surplus right there.

(Maybe Iraq's oil revenues would pay for it. You know, the amount left over after it pays for the reconstruction. Right?)

A word about social security. It is a regressive tax. In percentage terms, it hits the poor harder than it hits the rich. It is worse than a flat tax. Using that tax to help pay off the nation's deficit is inappropriate when it was originally designed to fund social security and nothing else. But that is exactly what Bush is making it become. A regressive tax that becomes a greater part of financing other government spending (including wars and tax cuts for the rich), especially as he reduces the benefits of Social Security.

So, that's Social Security, and what Bush wants to do with it.

Posted by Curt at January 6, 2005 02:23 AMCame across this article....http://money.cnn.com/2005/01/08/retirement/social_security/index.htm

Posted by: Abby at January 9, 2005 09:53 PMThis is remarkably fair, compared to what I read at Pandagon. But it still has mistakes.

1. Social security does not have a guaranteed rate of return. The rate of return can be changed by the government at will.

2. Your 4% does not go to the stock market, it goes to investments. US Treasuries if you like, or AAA rated corporate bonds, for example. It is not a brokerage account, and you will be restricted to a choice of diversified funds. So you are wrongly implying that people HAVE to throw their money into the terrifying stock market.

3. The "interest" the trust fund earns is merely more bonds. As you are well aware this is smoke and mirrors. Trust fund solvency is a meaningless concept. I think you are confusing GDP growth, which improves our ability to pay for the boomers, with Trust Fund interest, which is bogus.

4. I don't see how money going to private accounts is still part of the general fund. Looks like a sentence got cut off in there.

5. Private accounts are a supplement to social security, not a replacement. Disastrous investment performance (over 30 years for a diversified fund? Practically impossible.) will reduce that supplement, but not eliminate it, nor will it eliminate the basic social security benefit. Commission costs and "limited investment choices" are entirely silly objections.

6. When revenues go down, expenses go down - because people are opting to forego social security benefits!!! You have ignored this.

7. "Monkeying with the formula" is totally reasonable. One of biggest problems with social security is indexing to wages rather than inflation. This is just too generous, and you are relying on unconvincing populist appeals when you obviously know the subject matter better than that.

8. It makes no difference whether the private funds outperform "the market". They don't have to in order to beat what social security would have done with the same money.

9. There is no tax fleecing in not taxing you and letting you invest your own money instead. You are very unconvincing when you try to sound like an outraged taxpayer. You obviously see raising taxes as the best solution to paying for rising social security costs, so don't play pretend.

10. The "transitional costs" are, in a sense, merely accounting - social security obligations we already have but which don't count towards the national debt - replaced by actual debt. In reality, it doesn't change our debt picture and in the long term significantly improves it. Other countries have already gone through this process, and debt markets have shown they don't interpret it as an increase in indebtedness.

Posted by: Pepik at January 12, 2005 02:03 PMPepik, a couple of comments on your comments:

1. The "government" can change the effective rate of return at will. Who is the government? The last time I looked, it was us, which includes the people receiving benefits. You will have a say in whether the "rate of return" is changed. There is no guaranteed "return" for individuals. But there is a guaranteed return to the trust fund.

2. The trust fund money is already going into treasury instruments. The only way you can possibly get a better "return" is to invest in something with a higher risk than US debt. If you are just going to put it in treasury instruments, what's the point?

3. It is only "smoke and mirrors" if you believe the government can default on the instruments in the trust fund. The surplus SS revenues were borrowed from the trust fund in lieu of borrowing through traditional treasury intstruments. The idea was the government would pay interest to the trust fund instead of outside investors (which today is largely China).

5. Private accounts are a replacement for the part of SS benefits that won't be paid. It is only a supplement if your private account earns more than is necessary to replace the benefits you won't receive.

6. Could you elaborate? I don't understand what you mean by "forgo social security benefits." When revenue is down, you are forced to cut expenses. There is a limit to how much expense can be cut. In the business world, you either borrow at this point, or you go bankrupt.

7. I agree with you on this. I would like to see somebody examine the possibilities here. I think CPI indexing would be a bit too austere, but I would be open to backing off the wage indexing.

8. As mentioned above, private accounts would have to outperform the treasury instruments used by the trust fund. Will Wall Street donate their services to manage the investment portfolios? No? Then at the very least, your private account is going to have to outperform what you would get from a non-privatized SS by at least enough to cover the management fees. And what happens if you were unlucky enough to retire around early/mid 2001? I was lucky that most of my money was out of the market before the bubble burst. But I still haven't made back what I lost.

9. It will not necessarily require raising taxes to avert a future shortfall. As you pointed out, benefits could be lowered. Or retirement age could be raised. Or the trust fund could possibly invest in higher-yielding instruments (which I'm leery about).

10. Harkin Energy's sale of Aloha Oil was, in a sense, merely accounting. They got away with a slap on the wrist. Some of the things Enron did were, in a sense, merely accounting. The big difference was the scale of the "mere accounting." Now scale that up to the amounts you are talking about for the transition costs. It staggers the mind.

Let's say you get a mortgage and decide to go for an interest-only payment plan. As I hope you are aware, you still will have to pay back the principal at some point. Now let's say you borrow half the principal that you eventually will owe now and invest it in the Whiz-Bank Fund. So now I'm paying interest on the mortgage principal. And I'm paying interest on my margin account where I borrowed the money to buy Whiz-Bang shares.

As long as the return on Whiz-Bang leaves me with enough to cover the other half of the principal I will owe, and the interest on my margin account, and the management fees I pay to Whiz-Bang, then I'm OK. But what if it doesn't?

This isn't a perfect analogy, but it does point out the potential pitfalls of a "borrow now so I don't have to borrow tomorrow" philosophy. As for other countries having already done this, which ones? And how are they making out?

Posted by: Kevin at January 16, 2005 09:41 PMComments on your comments on my comments:

1. The guaranteed rate of return for the trust fund is totally meaningless. The bonds don't pay cash interest, they just pay more bonds. So the actual return for the fund is zero. Your benefits have nothing to do with trust fund returns or solvency - they are purely arbitrary, based on how much the government in power at the time you retire decides to pay. Nothing more.

Also, if you die early under SS you lose everything, but under privatized accounts this becomes part of your estate.

2. There are no trust fund assets. You've already agreed to this! Each trust fund asset is a government liability. The net is zero. Anyway, like I said, your SS benefits are tied to how much voters feel like paying when you retire. Its not the credit risk - there is none, whether you have SS or a portfolio of Treasuries - its the political risk.

The important thing is that "stock market" is being used as a scare tactic - making people think they'll need to pick the next Microsoft to retire in comfort. Nobody will be forced to hold stocks.

3. It is not only "smoke and mirrors" if you believe the government can default on the instruments in the trust fund. Deciding to cut pension benefits does not constitute a default. The supposed health of the supposed trust fund and the level of your SS benefits are totally unrelated.

Borrowing from the trust fund in lieu of borrowing through traditional treasury intstruments is phony accounting. Either you're going to concede that the trust fund is bogus or you're not, you seem to want it both ways.

5. The idea is to have SS pay the minimum needed. In that sense, private account dollars are a supplement to the minimum you need. For SS to pay more than the minimum is to have it stop being a program to prevent old age poverty and to start being a system that takes over the retirement planning of people who don't need it.

6. There is a matching - under privatization, when I agree to pay less into SS (although it doesn't go "into" anything), i also agree to receive less benefits from SS in the future - because the tax money is going into my private account instead. Thus this isn't a miracle supply side tax cut, paying for itself, there is an actual matching of revenues and expense, although with timing differences (and a very big transitional cost).

7. "I think CPI indexing would be a bit too austere, but I would be open to backing off the wage indexing." Probably me too, and it will need to be addressed regardless of whether or not a partial privatisation happens. In a lazy sense, since SS is a pay-as-you-go (make it up as you go along) system, if benefits start getting too low, we pay more. So there is no real need to fix a pay-as-you-go system in advance.

8. Private investments don't have to outperform the trust fund, because trust fund returns and SS benefit growth are unrelated. They should beat the implied return on money paid into SS, which is arbitrary and not based on any return, merely increasing expenditures by the government.

Typical equity mutual fund expense ratios are 1.5%, and this will be regulated under a privatized SS system. 1.5% can easily covered by investment returns.

You ask what happens if you retire in 2001. First let me note it is a good thing that we are proposing privatization so soon after a bear market - we are starting with pessimistic expectations, which is good.

But the answer is that nobody starts saving for retirement and retires 1 year later. You cannot start at the peak and end at the trough. People should be contributing to private accounts for 40 years, and they will continue to reap investment returns during their retirement (another 10 more years). If you had invested for 40 years and retired in 2001 you would be doing just fine, far better than you would have under SS. I could even contest whether anyone is going to be in 100% equity immediately before retirement - unless they are very risk tolerant, which is their choice (and they still have a guaranteed minimum from SS), but that's more of an aside.

9. First you would have to make the trust fund into an actual trust fund (good luck). It isn't now. THEN you could put other investments in it. I would be totally opposed though. I think such systems do exist in Singapore and Sweden.

10. I disagree with the analogy. The most important point is that this additional debt results from pension fund payments we are going to pay anyway - i.e. these are already liabilities, even if they aren't included in the national debt. By privatising, we also reduce future liabilities. So while some liabilities show up in the accounts and some don't, I don't think the overall picture is as radically different and people make it out to be.

Countries with privatised pensions include the UK, Chile, and Poland. The UK has the most privatised system of the rich countries, but it is Chile which is probably the best example - they privatised in 1980. I think they are all working out fine, but, like anything else, you can find reports describing them as "disasters" if you choose your sources right. That would be a debate of its own.

Posted by: Pepik at January 17, 2005 07:25 AMPepik, I guess we will have to agree to disagree on many things. If the trust fund had invested the surplus by purchasing the debt of another nation, would it still be nonexistent? What about AAA corporate bonds? Never mind. We will never agree as long as you don't think the debt instruments in the trust fund are real. That seems to be the underpinning of your entire argument.

Try looking at this article:

http://www.bepress.com/cgi/viewcontent.cgi?article=1048&context=ev

The fact I've heard over and over again is that the government has never defaulted on these treasury bonds and they are considered the most rock solid investment you can make. Now, yes, technically, the government could change its mind and decide to default on these things. But come on. Pepik, weren't you just complaining about scare tactics?

Now, one of the common areas of confusion in this argument is that you basically have to agree up front with your debate opponent as to whether there is a trust fund or not. It really is just a matter of how you look at it, so stipulate one way or another before you start arguing.

If you argue by accepting there isn't a trust fund, then it's true that there really isn't a rate of return, because the money is spent. But in that case, there is also no crisis - no tidal wave, no point of insolvency, no doomsday dates of 2029 or 2045 or whatever. It's just deficit, and we already have that. And the deficit in the social security account is nowhere near the deficit we have now, and the net drain it will yield will be nowhere near the level of, say, Bush's tax cuts.

Now, if you argue that there is a trust fund - defined as the total surplus that social security has brought in compared to what it's sent out - then yes, we can dicker about dates of insolvency. But you can't make the arguments about there being no growth in the surplus over time - growth that would mean there would be no insolvency date if the economy continues to grow at moderate rates.

There is no social security crisis. There is a national debt crisis and a deficit crisis, but regarding that, the Bush administration is the problem, not the solution.

Posted by: tunesmith at January 18, 2005 12:45 AMI made a couple of revisions to the article. In response to Pepik's first round of comments.

1) I added an explanation before the graph.

2) I added an explanation before the graph. I'm not trying to demonize the stock market; I enjoy investing in it myself. However, I think it's fair to point out that a group of private citizens investing in the stock market will almost certainly underperform the stock market itself. It's the money managers and professionals that outperform the market.

3) I clarified my section on the Trust Fund so it didn't mention "interest", but instead mentions GDP growth. As for insolvency, it does make sense if we're talking about the date of the so-called "tidal wave" in 2046 or whatever. But as you can see from my article, I stipulate that the trust fund is basically meaningless since the administration is spending all the money anyway.

4) Yes, it's part of the general fund in the same way that a bank can invest the money you deposit in your account. If you would rather look at it that the privatized money is YOURS that the government cannot touch, then boy howdy, we've got a real disaster on our hands with privatization - it basically robs our seniors of almost a third of their money.

5) A supplement to social security would be separate retirement accounts on top of the full 12.4% social security. Diverting up to 4% supplants, not supplements. The "basic social security benefit" is the full amount, not the part that is left over after privatization diversion is taken out.

6) It appears that you are trying out the point that privatization is actually a partial dismantling of social security. This is an honest argument and I wish Bush would say it out loud. But I also think that America would not agree with it. If we have a choice, we don't *want* it dismantled. The administration knows this, which is why they are trying to lie by saying that we don't have a choice.

7) The "unconvincing populist appeal" is your reading of it, but it doesn't mean you're correct. :) There is plenty of legitimate reason to oppose Bush's approach with the formula. I clarified that section of the article. I think that Bush's suggestion of indexing it to inflation is morally repugnant because it locks our seniors into an out of date standard of living, basically keeping them from being able to grow with society. Plus, it *changes* convention, when those paying into it came to expect a different service level. Why change it? Oh, right, because of the "crisis"? I thought you said there was no trust fund.

8) I added a clarification. And yet, if the private market outperformed social security to the point that private citizens were coming out ahead on average, then it would mean the economy was growing well enough that the social security trust fund would never run out, which means there's no more "crisis", which means there's no need to privatize. (And if there's no trust fund, it's still true that even if citizens come out ahead on average, there will still be plenty of citizens that will get a raw deal compared to what they would have gotten on social security - like running out of privatization money too soon if they live too long.) And honestly, given the historically high P/E ratios and the size of the deficit (which privatizing would make a lot worse) I think it's a tall order to expect that level of performance.

9) First of all, it is not really much of a tax cut if the overall benefit to me is most likely going to be less than it would if it all remained the same. Second of all, payroll tax is a regressive tax - even a flat tax would be better than what we have now. Finally, when you pay the government with an expectation of future benefits, and the benefits get cut after you've already paid, that's a fleecing. I'm actually in favor of removing the 90k cap, and lifting the lower end so people don't start paying payroll taxes immediately. Then the tax actually becomes slightly progressive, which is a tax CUT to everyone except for the people that won't need social security at all anyway. No need to raise retirement ages, no need to cut benefits.

10) I do not know all of what goes in to the transitional costs. It could be that it is just the cost of double-counting the private funds - is it mine, or is it a senior's? But if we are to look at the money as not being available to seniors, after which we need to borrow to pay for them, it still contributes to the deficit. Yes, we can borrow it over a long period of time, but that is still added to our total national debt, when our debt limits are already strained scarily. Just look at the dollar versus the Euro. And even on top of that, there are real bureaucratic and transitional costs that are significant and would not have to be spent at all if we didn't make the shift.

There is no reason to privatize. It's a bad solution looking for a wrong problem.

By the way, you made a point about social security, being that if you die too early, you lose out on the rest of the money. What rest of the money? It's always been that way. It's a pension plan. Now, look at privatization. If you live too long, then your private account gets exhausted and you become a lot poorer since your social security benefits are so much lower than they would have been otherwise.

Posted by: tunesmith at January 18, 2005 02:35 AMLet me quote Curt on the trust fund:

"Now, about that trust fund. Dirty little secret. It doesn't exist."

Is anyone disagreeing with this, or only when I say it? Or the story now that the trust fund doesn't exist, but the bonds in it do? How exactly does that work?

It is so simple - when the bonds in the trust fund mature, who pays for them? The government. And where does the government get the money to pay for those bonds? Tax revenue. Please explain to me how that is in any way different than never having the trust fund in the first place and just paying straight from general revenue.

And having specifically said that trust fund solvency is meaningless, I have now been instructed by Kevin to read a Krugman article which says that trust fund solvency is meaningless. Why do I get the feeling I'm wasting my time?

Tunesmith, thank you for cutting and pasting the usual answers without reading through any of the comments on this page, and then calling me a liar. I have said there is no credit risk in the fund - yet you accuse me of scare tactics for suggesting there will be a default. Then you lecture me that I cannot deny the trust fund exists while claiming there will be a "crisis", yet I never claimed there would be a crisis. Don't be Donald Rumsfeld - debate the point I made, not the ones you wish I made.

Posted by: Pepik at January 18, 2005 02:43 AMWell, you caught the web page just at the right time. I joked about pepik lying in a government-approved fashion, and later reconsidered and deleted that part of the comment (before I knew anyone read it) when my second reading of pepik's comment seemed more fair than it did at first. So, I apologize for that, Pepik.

And yes, I am responding to many of the general arguments made for privatization, and not just to pepik's points. In some cases, using the discussion to riff on other arguments that are out there. There's no deliberate intent to misrepresent.

Now, I may have misread what you were saying about the treasury bonds. When you said "the rate of return can be changed by the government at will" it read very much like you were saying the stability of the social security investments were subject to the whim of the government. I protested that that was silly. If that's irrelevant to what your point actually was, then you can disregard that.

As for whether there is a crisis, then maybe I'm missing something - why would someone that cares about governmental fiscal health be in favor of privatization if they didn't believe there was a crisis?

Well if i find out how to edit, i'll edit mine too.

I'm also getting confused about who is who here. But with regards to the adjusted summary, let me make the following comments:

2.1) Trust fund assets are rock solid. Unfortunately they have nothing to do with the level of your social security benefits. Think about it: guaranteed rate of return on what for whom? These tax dollars get spent immediately. It is guaranteed that you will get a pension, however what you get is purely based on legislation and the generosity of voters at the time you retire. There is no rate of return (guaranteed or not) for anyone - government or beneficiary. There is an implied rate of return to you in terms of your tax dollars in and your expected benefits out, but it is largely unknown and entirely arbitrary.

Also, I suspect you will be allowed to invest in Treasuries and FDIC guaranteed deposits. Thus you may not have to invest in something riskier than social security (noting that risks are not comparable, since one is a credit risk and the other a political risk). Anyway I realise this is a summary and not intended to explore every nuance.

"a group of private citizens investing in the stock market will almost certainly underperform the stock market itself. It's the money managers and professionals that outperform the market."

What's fascinating is that money managers and professionals don't outperform the market, although that's another mystery of capitalism. Ignoring that for a moment, you will not be getting a brokerage account to day trade. You will get to choose from a selection of approved funds run by "money managers and professionals".

4) I think GDP affects the level of payroll tax receipts, not return on the fund. Return on the fund, although imaginary, is probably based on the interest rates of the bonds. I may have got this wrong in an earlier email.

5) "A supplement to social security would be separate retirement accounts on top of the full 12.4% social security."

No, and you are missing the point - you are assuming that for some inexplicable reason Social Security has to be exactly the size it is, as if there were some logic to it. Social security was supposed to end poverty among seniors (which it largely did). So it pays out a minimum income. However, it does more than that - it pays out a higher than minimum income to people who earned higher than average incomes in their working lives. Why? If it is above the minimum, it is unnecessary. Why is the government guaranteeing better retirements for the better off? Once you have a guaranteed minimum income, it makes more sense to prudently divert any other money from social security so you can invest for a better retirement, rather than throw it into the practically zero return social security machine. Like I said before, if you still don't like this, invest your supplement in Treasuries and FDIC guaranteed deposits.

6) "It appears that you are trying out the point that privatization is actually a partial dismantling of social security. This is an honest argument and I wish Bush would say it out loud."

But what does dismantling mean? Everyone still has a guaranteed minimum income. Wasn't that the idea behind social security? How is it dismantling any more than re indexing benefits, which you could potentially support?

7) "It *changes* convention, when those paying into it came to expect a different service level."

I really don't care. If we indexed too generously, then we'll have to scale back eventually. Similarly, if people live longer, we'll have to change the retirement age some day. Sorry.

Keep in mind you can be as generous as you want. You'll just have to tell voters not to worry about social security because if there's a problem, the Democrats will fix it by raising taxes (on the rich). Good luck.

8) I never said we needed to privatise because of a crisis. I said we needed to privatise so we can pay lower taxes and have better retirement benefits.

I do not care what the P/E ratio is today if i am investing, incrementally, over the next 40 years.

Also, even Krugman would admit that by boosting savings and investment, privatization should boost long term GDP performance - a second benefit.

9) I will be better off with taxes diverted to my private account because I expect investment returns to more than cover lower social security benefits when i retire. So it is still a tax cut.

You can put the payroll tax in whatever terms you like - in the end all this talk of caps and floors and so on means you are raising taxes (and you thought "dismantling" was an honest description?). Keep in mind that social security benefits are just as regressive as the taxes (although I guess regressive benefits are called progressive) - all you are doing is finally acknowledging that there is no social security system, no funding, no trust fund - we're just arbitrarily taxing people and giving arbitrary amounts of money to arbitrary groups of people, with progressive intentions, just like welfare, which has no trust fund.

You have already said you could accept a reindexing of benefits. How about raising the retirement age - starting in 10 years. Is that a fleecing? Are we forever tied to the terms of social security set when demographics and lifespans were different?

10) I reject the transitional cost problem, to me it is as much a charade as trust fund solvency. But I'm not going to debate it.

By the way, you made a point about social security, being that if you die too early, you lose out on the rest of the money. What rest of the money? It's always been that way. It's a pension plan. Now, look at privatization. If you live too long, then your private account gets exhausted and you become a lot poorer since your social security benefits are so much lower than they would have been otherwise.

Regarding the last point, which I forgot to respond to, I doubt most people will want to exhaust their private investment accounts, for reasons of conservatism, and to provide inheritances. People suddenly live shorter, but they don't suddenly live longer. But up to then, they would have enjoyed better retirements anyway - so you can't say they are worse off.

And what about those people who live shorter lives and would especially benefit from privatization - who might they be? Which groups in society have the shortest lifespans: we all know that, its blacks and the poor. Guess that means social security has been robbing them from the get go. How progressive was that?

Posted by: Pepik at January 18, 2005 08:45 AMPepik, I'll respond more fully later. There are some good points. However, I think your point about blacks and the poor is offensive. Cut their benefits because they're not going to use it much anyway? Sheesh. If you really cared about blacks and the poor being at an inherent disadvantage, then the solution would be to support policies that would give them a leg up - not to cut their benefits. If they're poor, their "percentage of wages" isn't going to amount to much anyway.

How did you interpret it that way? The point is blacks and the poor would benefit from a privatisation since the current SS system is biased towards those with longer lifespans - white wealthy people.

Posted by: Pepik at January 18, 2005 04:37 PMPepik, it's a silly point. Auto insurance is also biased towards people that have car accidents. Social Security is about *security*, not about a particular lump sum of money. It doesn't even make sense to look at it in terms of cumulative amounts.

Yes, on average, groups of people with lower life expectancies get less out of social security than groups of people with higher life expectancies, assuming that all those people are subject to the same formula. But aside from that not even being the point of social security, it's not fair to the beneficiaries to look at this in terms of averages. Right now, what works with social security is that everyone - EVERYONE - is guaranteed their check until they die. Now, if it's privatized, that benefit is lessened, and that guaranteed check is shrunk dramatically. It is cold comfort to the person that outlives their life expectancy that someone else that died early is able to give their money to their heirs, and that on average the two beneficiaries got more money. It's a stupid way to look at it.

Now, as for the argument being offensive. Who on earth are you trying to convince with that point? Black and poor people? Blacks and poor people SHOULD NOT have a lower life expectancy. It's not as if they have a genetic inferiority or something. (The offensive part of the argument is that many folks offer that argument as a coded way to imply that they do. Should I give you the benefit of the doubt on this one?) So if blacks and poor people are poorer, that's a PROBLEM that is our responsibility as a society to fix. It's repugnant for us as a society to take this thing that we are *failing* them about, and represent it as a fact of life and a justification for a policy that accepts it as a reality. Why don't you just let me punch you in the face so I can sell you some aspirin? I mean, if you don't buy it from me, it would hurt a lot more.

If you defend blacks having a lower life expectancy to the point where you are just asking everyone to accept it, then what does that say?

So again, who are you trying to convince? Blacks and poor people? Believe me, it won't come across as you trying to do them a favor. The argument that you're parroting is constructed explicitly to activate classist and racist feelings.

I think your hostility is mostly because you are unaccustomed to, and uncomfortable with, seeing conservatives on that side of the argument. In fact it is perfectly reasonable to point out that African Americans are getting shafted by social security. We cannot legislate lifespans, but we can legislate changes to social security which would benefit African Americans and lower income individuals. I feel neither racist nor classist for pointing that out, and I definitely feel no need to prove my anti-racist credentials or earn your benefit of the doubt. I never suggested you were racist for supporting the current Social Security system, so what gives you the right to suggest I could be racist merely for proposing reforms which would benefit African Americans?

Auto insurance is a false analogy. People who have more accidents pay more for insurance. People who live longer (the risk to the government as insurer in our scenario) do not pay more for social security.

"Social Security is about *security*, not about a particular lump sum of money." The security is still there. The EXCESS, beyond the guaranteed minimum which was the premise behind social security, IS about the lump some of money - it is forced savings, and now you are not only saying people shouldn't be allowed to invest it for the best possible returns, they shouldn't even think they have a right to get it back at all. You keep saying "it isn't the point of social security" as if social security were some indivisible whole - my message all along is there is a core element to social security to which your logic applies (the minimum benefit), but social security is much bigger than that, and it is this excess part that I am talking about reforming.

Also, as an exciting newsflash, I have read that upon retirement, people will be forced to convert their private account investments into a retirement annuity - i.e. an annuity which pays out until death. While I had always thought this would be an option, I didn't realise it would be mandatory. So nobody will outlive their investments. And anybody who wants to add a life insurance component on to the annuity can do so and thereby ensure that if they die early, there will be a remainder to go to their estate. Aren't you excited about privatization now?

Posted by: Pepik at January 19, 2005 03:04 AMI notice you didn't respond to the main point of my comment. Anyway, you are arguing a point using itself as its own evidence. You missed what I was saying with auto insurance: insurance being biased towards those who have car accidents is a ridiculous concept. People don't *care* that they don't get their insurance money back if they can avoid a car accident. Social Security being biased towards non-blacks is a ridiculous concept. When someone dies early, their last thought is hardly that they've been gypped out of the rest of "their" social security money. You are so married to the point that you are somehow entitled to a set sum of money from social security that you are forgetting that that is the point that is actually under contention. Blacks and poor people aren't put at a disadvantage by social security. They get checks until they die just like everyone else. It's about security, not a set sum of money.

And, no hostility intended, I am sorry if I hurt your feelings. :-)

As for the guaranteed minimum, the guaranteed minimum is what is awarded by the formulas that are in place today. Again, you are taking your own objective as fact. The hypothetical post-benefit-cut amount is not the guaranteed minimum and you cannot call it that. That is under what the guaranteed minimum is as it is today. $700/month is less security than $1150/month. I think I saw a stat in the recent NY Times article that well over half of seniors would be in poverty if they weren't on Social Security, and $1150/month (the average, I believe) hardly makes someone fiendishly rich that is on the verge of poverty. You can't seriously argue that this is well above a reasonable minimum. How many cans of tuna do you really think they should be able to live off of?

Yes, I recently heard about it being converted to an annuity. If that helps you abandon the ridiculous point about blacks being screwed by Social Security, then fine. It's still too expensive to switch to privatization, though.

You might be interested in the post on my front page. I'm starting to challenge my own belief that there is no trust fund. Maybe there actually is a trust fund, but also a much larger-than-admitted present-day deficit due to Bush's runaway spending.

Posted by: tunesmith at January 21, 2005 03:14 AMI am afraid I still believe in the sum of money. As I said, the minimum is "insurance" - that's fine, if you don't collect it, so be it. I pay taxes for welfare and unemployment benefits, and may never collect them. That all fine too. I've already agreed on this - the problem is that you insist on looking at all of social security, for all people of all income levels at any level of benefits - as one indivisible whole which is "insurance". It most definitely is not. There is a minimum which is legitimately insurance and the rest is forced savings, and if you force me to save, how can you say its not mine? So PART of it is about *security*, but not ALL of it. And we're only reforming PART of it. There is a core social security that will be preserved and a part that needs reforming. Until you accept that, this argument is going nowhere.

Also, your premise kind of falls apart if you consider one additional thing - families. Whatever race or income group, if you're being forced to save, why shouldn't the money go to your family if you aren't around to claim it? That's where the poor and minorities lose out. I would most certainly feel robbed, and I can't see how you wouldn't. This isn't exactly an inconceivable scenario.

I have no expertise to offer on whether the current level of benefits is adequate, or whether reindexing is a good idea. Fortunately that is a totally separate issue from privatisation.

Anyway, pick whatever level of benefits you consider to be an adequate minimum - the point is that social security still pays above that minimum to many people, even people who have plenty of other savings or wealth or property or 401(k)s or IRAs or whatever. Forcing these people to pay into SS - not the redistributive part, just the part that is currently being paid out to people similar to them today - is a total waste. They don't need it and don't want it. They should have the freedom to invest it more productively.

The point of the annuity? Let me quote you:

"Now, look at privatization. If you live too long, then your private account gets exhausted and you become a lot poorer since your social security benefits are so much lower than they would have been otherwise."

Not so.

Posted by: Pepik at January 21, 2005 12:26 PMI may be wrong here, but don't most beneficiaries get far more money from their checks than they paid into the system anyway? Because so many workers die before retirement age? Isn't it kind of disingenuous for you to argue in favor of a "set sum of money" when even the beneficiaries that are poor or black are likely to get more money out of it than they put in?

Thought experiment. This is supposed to be about a minimum sum of money for retirement years. Say the privatized portion would be passed on to heirs if they died after retirement age. But if the worker died *before* retirement age, then the money would go to the government or to social security instead. After all, it's part of social security, a government-run program, and it's supposed to be about retirement security. Now, I might be showing my underwear here because I'm assuming that the privitazation plan isn't set up like that. But would you be in favor of that? Somehow I don't think you would be.

A lot of the privitazation advocates try to argue that this would remain part of social security, a government-run program, etc. But when you find out that they'd want the money to go to their heirs even if they die when they're 45 or whatever, then it's easier to see they're arguing in favor of raiding social security. The money is supposed to go to our social security beneficiaries and nowhere else.

There is a core social security that will be preserved and a part that needs reforming. Until you accept that, this argument is going nowhere.

But this is one of the more provocative points you're making, Pepik. You can't even define which part is which. This is an allegation you're making, not a fact. It's very much up to debate. If you were to ask most seniors which part of their checks were the "core" part, then it shouldn't be a suprise to hear them say, "All of it".

So if you're going to continue to insist that that is a fact, maybe this really is going nowhere.

Too bad because I'm (mostly) enjoying this debate.