March 08, 2005

Muse Captured

Attention, Attention. The Muse has been found.

Cuteness aside, yes, it's time.

I've left hints here before, but the day has come! Hunting The Muse is closing down.

And, something bigger and better is taking its place. I've felt strain here for a while because while I've gotten good response from my political writing, my other writing just hasn't seemed to quite fit. And as far as the political writing, I've wanted to take a next step.

I've got all that now. So, allow me to introduce my new home...

Politology.us: Politics and Technology in the United States.

I'm the captain over there, and there will also be occasional and regular guest contributors. This is a site specifically tailored not just for political weblogging, but for those that want to use online technology to engage politically. We'll be talking about technological issues, we'll be writing tutorials, we'll be collaborating on actual project development. In short, it will be a site attempting to bridge the gap between political SAYING and political DOING.

(That's "do-ing", not the sound effect.)

In addition? I have a few other personal projects in the mix. If you consider yourself to be a friend of mine (and odds are you aren't wrong), then you are invited to follow along on my new personal weblog, Thunder-Thumbs. It'll get pretty silly over there. Creative writing, miscellany, inside jokes. Come enjoy yourself. That's also where I will announce future ventures - so if you're interested in my programming or music activities, that's where you can find them.

As for museworld? Honestly, museworld was always intended as my music site. And music is finally started to pick up some momentum for me. Hopefully sometime in the next few months, we will see a bit of an overhaul here on good old museworld. You'll be able to hear about that progress on Thunder-Thumbs.

Old archived entries will stick around for the benefit of googlers everywhere.

If you've been a regular reader, thanks so much for hanging around and keeping tabs. The occasional comment and note has meant a lot to me. For most of my time here, I haven't really even risen to the level of a B-list blogger, but it hasn't really been about that - I've learned a lot about myself just from putting myself through the paces of writing regularly, and I've discovered some new passions. That was my goal all along, and it's been my honor to share that with you.

I hope you'll join me for the next steps.

In solidarity,

Curt

March 06, 2005

Social Security Privatization For Dummies

A continuation of my series...

President Bush is pushing to "reform Social Security". He advocates something he calls "personal accounts", which historically has been called "privatization".

What is privatization? How does it differ from what Social Security is now, and how does it affect Social Security - and us - in the long run?

This article attempts to explain President Bush's likely strategy, and the likely effects of it should it be enacted.

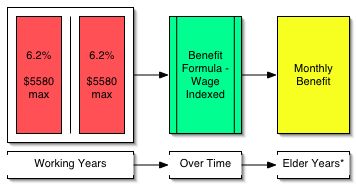

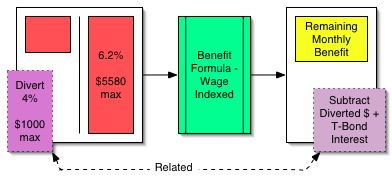

Every wage earner pays into Social Security, and we are all supposed to receive benefits from Social Security when we become eligible. This benefit level is determined by a formula. The details of this formula can be found elsewhere, but suffice it to say that it takes the amount of money we pay into social security, applies a formula based on "wage indexing", and determines a monthly benefit amount that we will get when we are eligible.

This is how it looks for an average person.

(* Benefits can also be received for disability or other reasons.)

When examining the impact of a changed Social Security policy, we must consider the effect it will have on each person, but we must also consider the effect on the Social Security system as a whole.

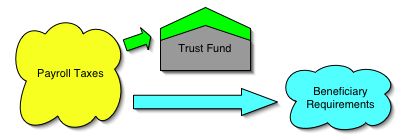

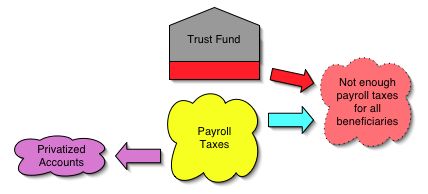

In recent years, Social Security has run a surplus. This means that the payroll taxes we pay are more than enough to cover all the beneficiaries in the current year. The surplus gets applied to a Trust Fund in the form of U.S. Treasury Bonds.

In later years, the baby boomers will have all retired, and the payroll taxes won't cover the needs of the beneficiaries alone. The bonds from the Trust Fund would be redeemed to make up the difference.

The idea is for the surpluses and deficits to balance out over the long run. The payroll tax rates were set in 1983 by a group led by Alan Greenspan, to ensure that Social Security's funding would balance out, far into the future. The state of the system right now is that Social Security is effectively balanced, well into the 2050's.

President Bush, however, sees the system as having problems. His view of the problem is inherently dishonest, as shown by a related article, Social Security For Dummies. His basic approach is to pretend the Trust Fund doesn't exist, by borrowing the money from the Trust Fund and then insisting the government can't pay it back (more commonly referred to as "stealing"). And since it is taking from a tax revenue stream funded by the poorer, to subsidize a tax revenue stream funded by the richer, it is basically stealing from the poor to give to the rich - a reverse Robin Hood, if you will.

Granted, this is a problem, but you'd think he wouldn't want to draw attention to it. Nevertheless, Bush is launching a campaign to convince the American public that Social Security is in danger, even though it's from him. If Bush's desire to steal from the poor is seen as a serious enough threat, then he will take the opportunity to try and implement his solution.

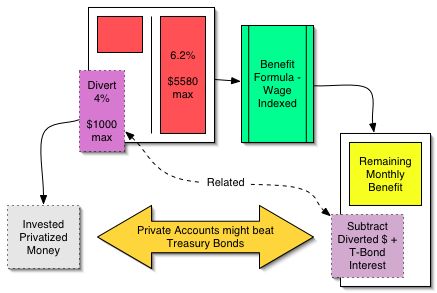

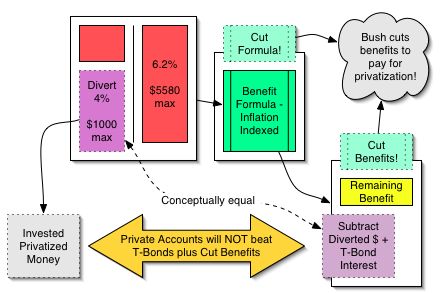

Here's how it would work. Privatization is about allowing workers to divert a portion of their payroll taxes into private accounts (or "personal accounts"). Because this is effectively withdrawing money from the Social Security system to try and earn greater returns elsewhere, their guaranteed monthly benefit is then reduced by an analogous amount. This is commonly referred to as a "clawback".

Financially speaking, this can be considered a fair trade. Since the money would normally be expected to grow a minimum amount over that time period (the growth rate of U.S. Treasury Bonds), the private account investor would have to beat that growth rate in order to break even by the time they become eligible. This is considered relatively easy to do if one invests responsibly.

This has a certain degree of financial balance. But even if the plan were to stop here, there would be plenty of reasons to oppose it. Paramount among them is that Social Security is an insurance plan, not an investment strategy. While many people would be able to outperform the default growth rate, some would lose money, and that is a bad scenario when we're talking about a system that is supposed to give our elderly a bare minimum to survive on. The average monthly benefit for 65-year-olds retiring today is $1184. That's not very far above the poverty line.

But, it turns out the plan doesn't stop here. For the plan has one large side effect. A very large side effect. A multi-trillion-dollar side effect.

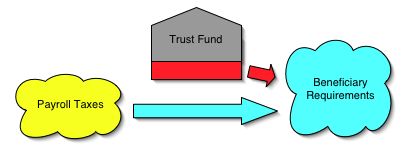

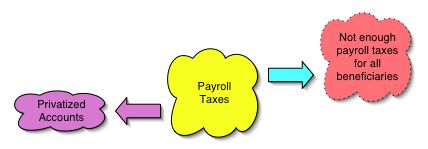

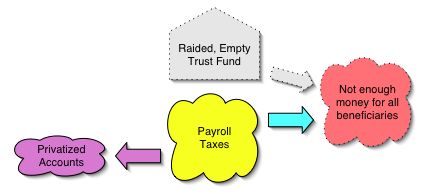

Remember that we are looking not just as the effect on a person, but on the system as a whole. If payroll taxes are going to privatized accounts, then what happens to the beneficiaries that were going to get that money?

If we put money into private accounts, then there's less money going to the beneficiaries. That money has to come from somewhere.

It could come from the trust fund. It would exhaust the trust fund a lot faster than the default plan would, but it's an option.

The problem that that, however, is that President Bush insists the Trust Fund doesn't exist (because he stole it).

So, we're back to that problem. The one that President Bush invented, but that he swears he has a solution for.

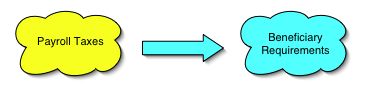

What's President Bush's solution? Rather than pay back the debt that was incurred to guarantee a certain benefit level, his solution is to default on that debt to the poorer citizens, and then cut the benefits they'd receive when they get older.

Basically, they rejigger the formula that determines the monthly benefit amount. There are plenty of ways to argue about the formula, but the big issue is that workers have been paying a certain tax rate with the expectation of a certain benefit level. Cutting the benefit level without refunding those extra taxes isn't exactly fair. The poorest 80% of the nation pays more in payroll taxes than they pay in federal income taxes, and then their promised benefits are taken away.

You can see the effect on the person. A well-performing personal account might have been enough to make up for the clawback, but it would be just about impossible for it to also make up for the benefit cut. Studies have shown that in order for the average returns to make up the difference, we would have to have a catastrophic crash in the stock market before privatization is implemented, and that wouldn't be good for anyone. And even if that happens, the average investor could hardly be expected to match average market returns. If Peter Lynch couldn't do it, how could the average investor? In short, the person loses.

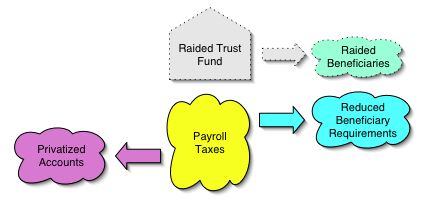

The effect on the system?

You have both a raided trust fund, and a generation of workers that are conned out of their promised benefit levels.

These are President Bush's goals. To acknowledge the Trust Fund long enough to spend the money, and then insist it doesn't exist. To borrow money from the poor, redistribute it to the rich, and refuse to pay it back; a robbery. To cut our promised benefit levels, require us to make up the difference by engaging in risky investments that further line the pockets of the rich, and then tell us we should consider it a privilege. And to give us a future where more of our elderly and disabled are below the poverty line. All in the name of reform.

This is not reform. It is destruction.

There are no plans to cut the payroll tax rate, so benefits should not be cut either. If anyone wants to receive the benefit levels they have been promised over the last two decades, then there is only one position to take: oppose Bush's plans for personal accounts. Leave Social Security the way it is. If there ends up being a real problem with Social Security, we can deal with it later. For now, we must protect our elderly, our disabled, and ourselves from President Bush.

March 04, 2005

Have No Fear, Blog Still Here

Blogging's been a bit sparse lately, but I have some fun plans that I hope will come to fruition soon. Stay tuned!

Fact Check Confuses Facts Again

I smelled a rat in factcheck.org months ago. They've been in the news more often lately. Here's the latest.

March 01, 2005

Libya

The resignation of the Libyan government is obviously a direct result of Howard Dean being elected chair of the the DNC.