January 28, 2005

How To Protect The Trust Fund

People often talk about the Social Security Trust Fund, how it's a tidal wave or a financial crisis when it runs out.

Social Security starts costing more than it gets in payroll taxes in about 2018, or 2028 if you count the interest the bonds have accrued. According to the CBO's middle scenario, the Trust Fund is exhausted around 2046.

I have a simple idea to help protect the Social Security's future viability.

Many Social Security beneficiaries pay income taxes on their checks. Those taxes, I believe, are counted as part of normal progressive tax revenue.

That revenue should instead be counted as part of Social Security's revenue. The taxes that people pay on Social Security checks should go back into Social Security.

This is assuming it doesn't already do that; I don't know for sure. And it probably wouldn't push any of those dates out to infinity. But it would push them out a ways, and make it more solvent in general. And, it has several other advantages:

- It isn't a benefit cut. It doesn't reduce the money that people get from social security.

- It isn't a change in means testing or retirement age.

- It wouldn't be a tax increase for anyone. Payroll taxes would remain the same.

- It scales. Meaning, as more and more retirees start receiving benefits, more and more taxes would be generated. So it would not only increases Social Security's revenue, it would also mute the affect of several retirees becoming beneficiaries at once.

- It just sounds good politically. If you owe taxes on your social security income, have it go back into social security to help other beneficiaries that need it more.

One possible protest is that it would take away from progressive tax revenue. However, the progressive tax system has been benefitting for years from the far greater sums of the Social Security surplus. This adjustment wouldn't even completely make up for it. And there's something to be said for refocusing the normal government on the need to make normal spending match up with normal tax revenue.

Update: Well, it appears that the tax revenue from social security checks already does go to the social security trust fund, at least mostly. So it turns out this is a non-starter. I got an interesting reply back from the CBO, though.

Bush's Budgets: A Graphic Explanation

I've been playing with the figures over at the Congressional Budget Office and I have some more graphics that people should feel free to use to make their points.

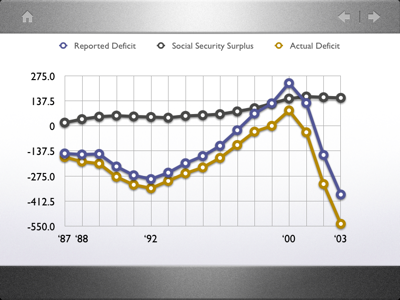

First, lets look at the budget over the last few years, how the Social Security surplus has been affecting it, and how much Bush has screwed things up in four short years:

That's quite a drop. Also, notice that Bush has regularly been reporting the deficit figures after Social Security has been figured in, while the real deficit is much lower.

[Note: most presidents do that, but the pro-privatization folks are then saying that when Social Security reaches deficit, that we won't be able to afford to pay it back, that it is a "crisis". When in reality, it's just a debt the government owes to Social Security that they should pay back. Since this "crisis" language is basically admitting that they are taking from a regressive system, giving to a progressive system, and not intending to pay it back, they are basically advocating stealing from the poor and giving to the rich. For a more in-detail explanation of this, see another graphical exploration, Social Security For Dummies. ]

Many people insist that it is more economically pure to look at this graph in terms of GDP, so here is the deficit over the same time range as a percentage of GDP:

So you can see how the GDP growth compresses things as time moves forward. Bush's figures are not quite as bad as his daddy, but the drop-off is still incredibly steep. It's not much of a defense for Bush.

Next up is the budgetary projection. The CBO has released figures for what the budget could look like over the next fifteen years. They react to past performance, assume historical spending growth rates, and other than that assume everything else will remain the same as it is now.

These are the figures that Bush touts as halving the deficit in five years. Note that he's talking about the deficit numbers as affected by the Social Security numbers; not the real deficit. It's mostly the growing Social Security surplus that allows him to make that claim.

Here are the same numbers as a percentage of GDP:

Now, here's the thing. Bush is relying on these numbers as a defense for his policies. But at the same time, Bush is advocating several other policies that will make his projection untrue.

The CBO offers estimates for several of these policies. The first one is Alternative Minimum Tax reform. Bush doesn't exactly advocate this one out loud, but it's widely accepted that this will need reform soon because it is starting to negatively affect middle-class citizens, what that wasn't what it was designed for.

Here is the projection of how AMT reform will affect the deficit. We'll stick to the real deficit for now, the one not adjusted by the Social Security surplus:

Next up are the continuing costs for Iraq and Afghanistan. These are the ones that rely on current assumptions of the cost of both, with neither seeing an escalation that would require even more funding.

Finally, the most dishonest part of Bush's arguments. Bush has already publicly argued in favor of making his tax cuts permanent. It turns out that the CBO's figures all assume that every single tax cut will sunset as originally designed. But Bush is making it a high priority to remove the sunsets and make all the tax cuts permanent, even though he's touting the baseline budget projections as a defense for his policies.

Here is how the permanent tax cuts would affect the deficit:

You can see that what Bush really wants is for is for us to not only increase our debt each year, but to increase it *at a faster rate* each year.

Let's look at this in terms of total debt held by the public. This doesn't include things like the amount of money the government owes to Social Security, it's strictly deficit-caused debt. (I may be somewhat incorrect in this definition, please correct me if so.) We already have a significant national debt. The deficit adds to it every year. Let's look at how Bush's deficits are going to affect our national debt over the next few years.

One note: in order to see it, we have to zoom out.

Way out:

But wait! the economic junkies say. You have to look at it in terms of GDP percentage! And to be fair, look at both its history, and its projections.

First: can we all collectively admit now that Clinton saved our collective hides? Man.

Now, according the graph, the debt in terms of GDP percentage doesn't look.... horrible... compared to historic levels. But - again, these numbers are the CBO baseline projection. I don't have the yearly corrected deficit numbers in terms of GDP, but I do for the public debt. So let's look at it again, with the AMT, Iraq/Afghanistan, and tax cut corrections figured into the public debt as a percentage of GDP:

So there you have it. An ever-increasing debt, even in terms of GDP percentage.

Now, a few notes. These correct projections here that we're looking at still don't include several things:

1) Any Bush "corrections" or supplemental appropriations like the one we just had come up for Iraq and Afghanistan

2) Social Security privatization costs

3) New tax cuts or spending programs

4) New wars

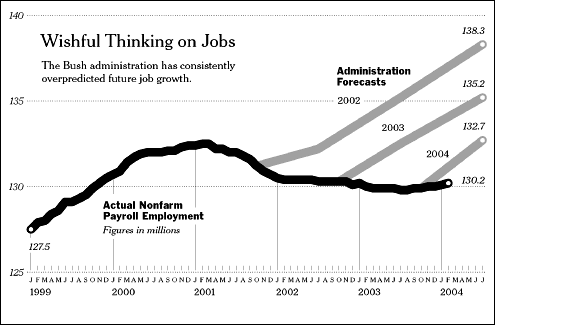

Also, Bush already has a history of making budgetary projections in the past and having them be completely wrong. It's a bit of a incompetence that probably should be figured into this as well.

Now, I have a few questions I have:

1) Does anyone have a source for prior Bush budget projections? I'd love to put together a graph series that says, "In 2001, here is what Bush projected for 2002 and beyond. Here's what actually happened. In 2002, here is what Bush projected for 2003 and beyond. Here is what actually happened..." etc.

2) Debt percentage of GDP isn't actually projected to match where it was during Poppy Bush's reign. Interest rates and other economic indicators were bad back then, but they weren't Argentina-horrible. Given that, is all this talk about major financial market collapses a bit overblown?

Please consider forwarding this around if you think the summary would be helpful for other people to understand.

January 26, 2005

But Social Security Is Unfair To Blacks!

Eschaton:Missing: Bush administration initiatives to improve African-American life expectancy. Discuss.To recap, life expectancy at 65 is fairly close for blacks and whites (2 year gap roughly). Much of the difference is due to differences is infant, childhood, and for males, young adult mortality.

Such people pay little or nothing in social security taxes. Many of them, however, receive social security survivor benefits.

Bush has yet to address the high infant mortality rate of African-Americans. Discuss.

Anyone making the argument that social security is "unfair to blacks" without pointing out these facts is a liar. Studies have shown that overall the rate of return for African-Americans is as good or better than for the overall population, when disability, survivor benefits, and level of contribution are taken into account. Your mileage may vary, depending on your income, date of death, and other life circumstances.

Flowers, I Tell You! Flowers!

Best political cartoon I've seen so far on Social Security and privatization.

January 25, 2005

Privatization Thoughts

Here's a thought experiment for you.

Aside from the part about cutting the money that goes to Social Security, what is the difference between voluntary privatization (or "private accounts" or "personal accounts"), and a Traditional IRA?

Why do we not make the point that our existing IRAs and 401(k)s contribute to the funding of Social Security?

(Answers: Not much, and Because it's frigging dumb.)

So if the GOP believes this to be about greater personal choice, why not just raise the maximum contribution to an IRA? Or create a new kind of IRA that would be converted into an annuity upon retirement? I'd be in favor of either, and neither would mean you'd have to cut Social Security.

Update: One commenter on a different thread made the point that one difference is that a poor person wouldn't be able to afford to send an extra few thousand dollars to an IRA, when they could if it were diverting payroll taxes (and thereby cutting social security). So... maybe the answer is to raise the amount before people start paying into social security (and also raise the cap after with they stop paying), and have that first bit go into an IRA automatically instead.

But All Presidents Spend The Surplus!

The only real objection that has come up against Social Security For Dummies is that I make the point that Bush is spending the Social Security Surplus and considering it an offset to the normal budget deficit. The objection makes the point that all presidents do that, so it's not fair to single out Bush.

However, in the piece, I also explicitly say that spending it is fine if you intend to pay it back. I also say that it is not Bush's intention. That's what sets him apart from the other Presidents.

The payroll tax was designed for social security, not for normal government spending. If the government borrows it, it has to pay it back. If it doesn't pay it back, then it is welching on its debt, or "stealing" in other words.

The remaining counterpoint I've seen to that is that if the government borrows from itself, it isn't a concern because it all just sorta cancels out in the long run. That it's really the people's money, your money and my money. So why make such a big deal out of what is essentially paying myself back?

That point is silly enough that it makes me wonder if the people offering it are just trying to deliberately confuse the issue. I'd prefer to have an honest debate.

The correct response is that you have a progressive tax system borrowing from a regressive tax system. In a progressive tax, the rich people pay a higher percentage of their income to taxes than the poor. In a regressive tax, the poor people pay a higher percentage of their income to taxes than the rich.

So if you have a progressive system borrowing from a regressive system, and not paying it back, then on average, you have the rich stealing from the poor.

Bush's arguments advocate this approach. Clinton's did not. That's the difference.

So, there you have it. Bush as the opposite of Robin Hood.

Elderly Budget Pressures

MSNBC - Elderly to put 'phenomenal' pressure on budgetFirst, it's a slanted headline, but I might be taking it that way just because of the amount of work I've put into communicating Social Security lately.

But it turns out the article is mostly talking about medicare and medicaid, not social security.

And it's kind of funny, because it undermines Bush's message so much. He's trying to say that Social Security is in crisis, but he's the one that passed a Medicare bill that is turning into so much larger of a drain than Social Security. Just look at the following graph from the article:

And this is knowing that the Medicare bill is a dreadful bill, with so much money in giveaways to the drug companies (which I don't know the details of, but believe), and that it's got to be possible to offer higher medical benefits at less cost with an adjusted bill. Given that it undermines Bush's social security message, it almost makes you wonder if Bush was as steamrollered by the lobbyists as progressives and elderly see themselves steamrollered by Bush.

January 24, 2005

The Deficit

I'm playing around with tables and graphs, and here's one that I know I've seen before, but it's still really interesting to look at.

This is how our budget has looked over the past fifteen years or so. Those year markers are the beginning points of each President's term. It plots the deficit numbers and how Social Security affected those deficit numbers.

What I'd like to do is get more numbers. I think I can find most of it through the CBO website. Like, projected Social Security behavior versus projected budgets.

But what I'd really like to find is a nice tabular format of data of Bush's prior year projections, and how they compared to what really happened. You know, "Here's Bush's 2001 projection of the next few years. And here's what really happened. Here's Bush's 2002 projection of the next few years. And here's what really happened. Here's Bush's 2003 projection of the next few years..." Etc.

Something like this graph about Bush's job growth projections:

Better Spam Control For Mail.app

So, spam filters are great and all, but you still have to check for false positives.

I hate that. So, I finally figured out a system that works better for me.

I downloaded SpamSieve and installed it. But rather than use it in its default configuration I did the following:

- I left Apple's Junk Mail filter enabled. This created three categories of spam. Those that only Apple caught, those that only SpamSieve caught, and those that both caught.

- The ones that only Junk Mail catches are very rare, under twenty a day. They go to my Junk Mail folder. They sometimes have false positives, so I review them regularly before I train the rest as SpamSieve spam. (I have "train" set to automatically delete the mail.)

- The ones that only SpamSieve catch are almost always spam, but it's theoretically possible that they could be false positives, even though I have SpamSieve on conservative settings. SpamSieve does automatically give these "Junk Mail" status, so that solves that part. I review these regularly too, sorting by color so the least spammy ones are on the bottom.

- The ones that both catch are by far the majority of my spam. Since I have SpamSieve on conservative settings, then I figure good enough. That's a double-positive, so bam! I just delete those suckers. (I will soon set the rule to automatically delete them, actually.)

So there you have it - a spam system where you don't even have to check the vast majority of your spam for false positives. I figure that if someone is going to send a legitimate email that two entirely different spam systems will classify as spam, then that's their tough luck.

That's More Like It

The Left Coaster: Senate Democrats Lay Out Opposition Agenda This MorningSeveral Senate bills descriptions. All worth reading, and based on one quick read-through, all worth supporting.

January 23, 2005

Social Security Pamphlet

A daily kos user named Susan has put Social Security For Dummies in pamphlet form. You can print it out and assemble it into a booklet. Better yet, print out multiple copies and drop them off anywhere where people might pick them up - community centers, coffee shops, etc.

January 22, 2005

Privatization Flaws

Twelve Reasons Why Privatizing Social Security is a Bad IdeaAn excellent article that is directly relevant to many of the questions that have come up in recent comments on this blog.

SS Links Spreading

Social Security For Dummies reached the top of the "recommended list" over at DailyKos. Here's the discussion.

Since then, it's been linked to by Blogpac's new Social Security website, There Is No Crisis.

Technorati shows several links being to the article, both via this page, and via the dailykos article.

Someone is evidently creating a Flash presentation off of it, and someone has already completed a six-page zine-like pdf pamphlet. I'm just waiting for the link. It'd be great if people could print it out and leave it in their local coffee shops.

Consider linking to the article if you want to help spread it around.

January 21, 2005

Social Security For Dummies

I have been creating some "Social Security For Dummies" graphs that anyone is welcome to use.

Update: This can now also be passed around in pamphlet form. Print out and assemble multiple copies and leave them in local coffee shops or community centers. Download here, mirror here.

Social Security For Dummies

Social Security is funded by a payroll tax. When we make wages, 6.2% is taken out of our paychecks to go to Social Security. An additional 6.2% is matched by our employers. This stops after the first 90k of income for each person.

In a perfect year, the Social Security beneficiaries would need exactly as much money as we pay in taxes. However, most of the time, the amounts are unequal. When the baby boomers retire, they will require more money than the payroll tax generates.

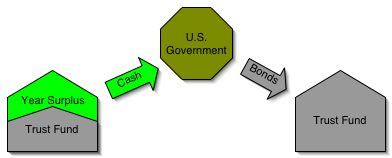

To make up for this, we have years where we generate more in payroll taxes than we need to spend on beneficiaries. This excess goes into a Trust Fund. The Trust Fund grows each time there is a yearly surplus.

Later, when there are years where the beneficiaries require more money than the payroll taxes provide, we can take money from the Trust Fund to make up the difference.

Since 1970, there have been 11 different years where we have had to do that, and it's worked fine.

How does the Trust Fund work? When excess money is generated, Social Security is required by law to invest the money in U.S. Treasury Bonds, considered the safest investment on the planet. They are issued by the U.S. Government, who has never defaulted on them. These bonds are supposed to be cashed in later when extra money is needed.

So, Social Security's Trust Fund is a big collection of bonds, and the U.S. Government gets the cash.

What does the Government do with this money? It spends it. That is theoretically okay if the intention is to pay it back later, but that is not Bush's intention.

In 2003, the Bush Administration ran a deficit of $536 billion. Social Security ran a surplus of $156 billion. (The Postal Service also ran a surplus of $5 billion.) So, the Bush Administration reported a deficit of $380 billion instead of $536 billion, ignoring the fact that that money is supposed to be earmarked for future bond redemptions.

Now the Bush Administration is saying that when beneficiaries require money than payroll taxes generate - 2018 or 2028, depending on who's talking - that we will not be able to afford it.

This basically means that the Bush Administration is following a policy of ignoring the Trust Fund entirely. Rather than viewing excess money as going to the Trust Fund, they view it as going to the government:

And then when the time comes, they will see the extra money that the Beneficiaries needing as coming from the government, from cashing in bonds:

They will then paint this as a problem - even though this is exactly how it is supposed to work - because in their mind, it would require higher government spending. And the GOP can't have that. So instead of paying us back, they say that benefits would instead need to be cut.

It is important to recognize what they are doing here. The payroll tax is a regressive tax designed for Social Security. Normal tax is a progressive tax designed for normal government spending. They are two separate systems. Revenue and Spending need to balance out in each system, and they should not intermingle:

But the Bush administration applies payroll tax to the normal deficit, claims that the trust fund does not exist, says Social Security needs to be cut, and implies that the government isn't good for their U.S. Treasury Bonds anymore:

To summarize, the Bush Administration takes the extra payroll taxes intended for Social Security and spends it on war and tax cuts:

Then, Bush declares there isn't money for when the Social Security beneficiaries require more money than the payroll taxes supply, and says the only solution is to cut Social Security benefits:

When actually, the truth is that the surplus is supposed to be applied to social security in later years:

While the following shows what the real problem is, in red, white and blue:

January 15, 2005

Bad Fish

You want some nightmares? Go check out the pictures of the weird fish that the tsunami washed up. Creatures no one has seen before.Update: D'oh! Urban legend. The fish exist, but it's not from the tsunami.

January 13, 2005

Wiki Working

Wikis are cool and all for group collaboration, but I also really like using them for my own brainstorming.

I am using VoodooPad Lite on my laptop to brainstorm my various ideas. Works pretty well.

The only thing is that it doesn't have revision history and diffs. I love revision history. I want to clean up my current thoughts, but also be able to access the thoughts I used to have.

So for now, I'm using Instiki for that.

What's nice is you can link directly to an Instiki page from VoodooPad Lite, so I can do my quick jottings in VP Lite, but then click to go to an Instiki page if I want revision history.

What I really want is a Cocoa wiki with revision history. Actually what I really really want is a Cocoa revision/diff code framework so that any Cocoa application can easily apply it to a textedit box.

January 11, 2005

DNC Chair: Rosenberg, Dean, and Trippi

1. Netroots darling Dean announces he's running for DNC chair.

2. Hours later, Joe Trippi announces he endorses Netroots darling Simon Rosenberg.

3. ???

Update: Well, this is fun. Daily Kos uproar. Jerome Armstrong: "What the hell was he thinking?".

Trippi's attempted spin:

"No, it's not about Howard, it's not about opposing him. I think Howard Dean should run for -- if he asked me for advice, he doesn't do that these days -- but I'd tell him to run for the U.S. Senate, to run for President in 2008 if he wanted to, I think he's got a lot of assets. But I think this is, right now, about building this party.... I think Simon-- I've worked with all these guys, all of them, and I think Simon Rosenberg is the best person."

January 10, 2005

Gay Marriage Tolerance

After a lot of thinking, arguing, and writing, I'm down to one nut that I can't crack, regarding how to argue in favor of gay marriage to those who are on the fence.

I think that since we're basically trying to convince people to vote in support of gay marriage, we can't really tell people that it's okay to be opposed to gay marriage. That's just mixed messages. At its root, we're telling people that they shouldn't be so opposed to gay marriage that they would vote against it. I think that saying, "Oh, it's okay to be against gay marriage. But vote for it anyways," comes across as pretty insulting to them.

But, it is considered reasonable to allow for people to be morally opposed to homosexuality. It's the old argument of how we can't force someone to be okay with something they just aren't okay with.

And, so it just gets stuck there. Here we are telling people it's okay to be opposed to homosexuality, but that they shouldn't be opposed to gay marriage.

It doesn't make sense to me.

January 09, 2005

SS Privatization != Pension

An email to Josh Marshall makes clear another gotcha with the Social Security privatization, by explaining exactly how it isn't a pension.

January 06, 2005

5000 Americans unaccounted for

5000 Americans unaccounted for:

Australian Press reporting that Powell concedes that the American death toll from the tsunami could be as high as 5,000. That's more Americans than died in the 9/11 attacks.

Social Security Summary

So, here's a bit of Social Security for Dummies. This is a partial reprint of an earlier post, but with more information.

First, a graph of what Bush plans to do with Social Security, with a before and after. A couple of disclaimers about the diagram: "Guaranteed" is a bit absolute, but the social security investments are considered rock-solid. "Stable" and "Unstable" might be better words. Also, a person doesn't have to choose to invest their privatized money in the stock market, but collectively, the people with privatized money will be putting their money in riskier investments.

This diagram is based on estimates of the Bush plan allowing workers to send up to four percentage points of their social security contributions to private accounts. The press coverage has been poor, saying, "four percent of payroll tax" when they really mean four percentage points of the 6.2 percent they send along, like what you see in the graph.

It's not currently known what happens to the employer match, so we'll assume that goes straight to Social Security for now.

Now, why does the Bush Administration say they're doing this? Because of a crisis! Because of an iceberg! Because of an unsustainable course, after which we'll hit an iceberg, which will cause a crisis! I promise, Jack! I'll never let go, Jack! Glug glug!

So, what's the nature of this crisis?

For a while, social security had as much money coming into it (from worker's paychecks) as was going out of it (to seniors). Then, folks got scared about the massive amounts of baby boomers retiring. So, in the 80s we started putting more money into it, so that each year there would be more coming in than going out. That created a surplus over time, at least if you looked at social security as its own separate government account. Later, the baby boomers will retire, and each year there will be more going out than coming in, eating away at the accumulated surplus.

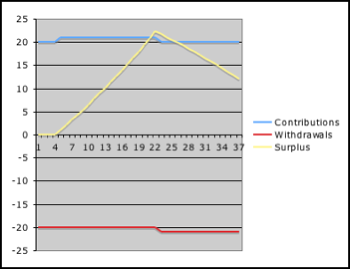

Here's a graph of an analogous situation:

Conceptually, it's the same thing. Say that for a few years, I made 20 bucks and spent twenty bucks. Then for a few years, I made 21 bucks and put the extra buck in a savings account. Then for a few years, I made 20 bucks but spent 21 bucks, and started draining savings. You can see there that the savings account - the surplus - is draining, and I'd eventually be broke.

Now, the wildcard is that when we put money in savings accounts, we get interest. In my above graph, I have the interest set at 2%. Right now, the social security surplus is growing due to our GDP growth, which is conceptually similar to interest, so the surplus degrades slower than it would otherwise.

So what's the iceberg, I mean, crisis? It's that foreboding day when the surplus is eaten away, when the Yellow line goes below 0, and when social security's operating costs become a net drain and start contributing to.... well, the deficit.

Yes, the crisis is that the Bush Administration is trying to avoid a deficit. As if that's ever been a big deal to them before.

Now, here's something funny about when this zero-crossing is supposed to happen. 10 years ago, the projected date was in 2029. Now, the projected date is in 2046. It keeps getting pushed further and further into the future. Why does that happen? It's because they make these projections based off of very conservative growth rates in our economy. But even with the crappy economy of the past few years, we've beaten those projections. What happens if we use more moderate growth projections?

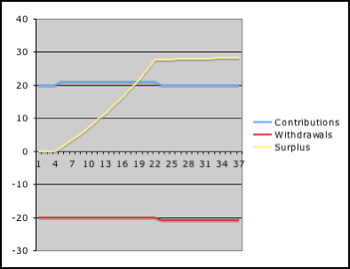

Well, let's go back to my twenty bucks scenario. I mentioned how the graph assumed an interest rate of 2%. What happens if I go up to 4%?

All of a sudden, the interest I make on my savings is enough to account for the yearly imbalance, and I make more money besides.

And that's what happens with social security. If we use more moderate economic growth projections, the surplus will be big enough to pay for the baby boomers, and then some. There would be no crisis at all. None.

It's a delicate balance. A shift of 1% can make the difference between being a millionaire or a pauper in forty years. A shift of 1% can make the difference between social security becoming a dividend to help pay down our national debt, or a drain that contributes to every year's deficit.

Now, about that trust fund. Dirty little secret. It doesn't exist. It's really just all mixed together into a big government checkbook (the "General Fund"), into which come tax revenues, and out of which go government spending, including social security payments. Like we already know, we already have a deficit, a big one. We have a huge national debt. It's a big problem. The Bush Administration's big argument is that a deficit is a big, really bad thing to be avoided at all costs. Are Bush's expenditure choices in line with wanting to pay down the deficit?

While the that chunk of money is going to private accounts, it's still part of the General Fund and doesn't just disappear from the wallets of our seniors. But, it's easy to see how the shift could mean a net reduction in Social Security revenues, or another drain on the deficit. Commission costs. Limited investment choices. Poor stock market performance. You might believe you can beat the market, and I might too, but can we really trust every other Joe Schmoe out there to make good investment decisions? If they don't, the General Fund suffers. There's not a lot of collective upside here overall, and there's a lot more risk.

So, contributions could go down, making the problem worse even as the baby boomers are beginning to retire. Remember the delicate balance. If revenue goes down, then expenditures have to go down too. Here, Bush chooses to decide to push social security expenditures down. There are a few ways to do this - raising the retirement age, or means testing. But what Bush is choosing to do is monkey with the formula that determines how much money we get back, by freezing beneficiaries at a standard of living that does not grow with society's demands - all of us, even the folks that will need it most. We'd pay just as much into it, but we'd get less back.

So you've got a trumped-up crisis that probably doesn't exist at all in basic reality. You've got a private-accounts panacea that probably won't perform as well as the market itself will, and with prospects of matching the status quo that are questionable at best. You've got a government that makes poor economic projections to justify the crisis, but rosy economic projections for the exact same time period to hype the private accounts. And you've got a tax fleecing that takes our social security contributions away from us and gives less of them back than before. All to change a system that already has a good chance of actually helping us to pay down our national debt.

And that skips one major thing - the amount of money it will cost to transition social security to this new system. Most common estimate I've heard? Two Trillion Dollars. A drain on the General Fund, and no plan to pay for it. If you look at it in terms of Social Security (after all, it is the checkbook that best applies), then that drains a big chunk of that baby-boomer-financing surplus right there.

(Maybe Iraq's oil revenues would pay for it. You know, the amount left over after it pays for the reconstruction. Right?)

A word about social security. It is a regressive tax. In percentage terms, it hits the poor harder than it hits the rich. It is worse than a flat tax. Using that tax to help pay off the nation's deficit is inappropriate when it was originally designed to fund social security and nothing else. But that is exactly what Bush is making it become. A regressive tax that becomes a greater part of financing other government spending (including wars and tax cuts for the rich), especially as he reduces the benefits of Social Security.

So, that's Social Security, and what Bush wants to do with it.

Belief Over Proof

There's a fascinating article over at the World Question Center - about what various notable thinkers believe but cannot prove (or consider to be currently unprovable).

There's some good stuff there, and some disturbing stuff (to me). Most of the disturbing stuff is along the lines of scientists scoffing at the role of emotion in decision making.

But here's the most disturbing one I've found yet, by Susan Blackmore:

It is possible to live happily and morally without believing in free will. As Samuel Johnson said "All theory is against the freedom of the will; all experience is for it." With recent developments in neuroscience and theories of consciousness, theory is even more against it than it was in his time, more than 200 years ago. So I long ago set about systematically changing the experience. I now have no feeling of acting with free will, although the feeling took many years to ebb away.But what happens? People say I'm lying! They say it's impossible and so I must be deluding myself to preserve my theory. And what can I do or say to challenge them? I have no idea—other than to suggest that other people try the exercise, demanding as it is.

When the feeling is gone, decisions just happen with no sense of anyone making them, but then a new question arises—will the decisions be morally acceptable? Here I have made a great leap of faith (or the memes and genes and world have done so). It seems that when people throw out the illusion of an inner self who acts, as many mystics and Buddhist practitioners have done, they generally do behave in ways that we think of as moral or good. So perhaps giving up free will is not as dangerous as it sounds—but this too I cannot prove.

As for giving up the sense of an inner conscious self altogether—this is very much harder. I just keep on seeming to exist. But though I cannot prove it—I think it is true that I don't.

January 05, 2005

Contested Election

Something pretty damn big might happen tomorrow.

The press will roll its eyes because they don't know how to deal with it.

But for the first time since 1877, the presidential election may be contested.

In 2000, they were unable to find a Senator. This year, word is they have one.

Now what happens if that happens? In terms of cold hard calculus, maybe not much. Others have more details, but I believe the two bodies of Congress will retire and separately decide whether to accept Ohio's slate of legislators. The GOP has the clear majority in both bodies.

But beyond that, what happens is what we make happen. There were very bad things that happened in Ohio that the GOP is trying to keep quiet, and they've broken the law to do so.

Reform Democrats

On the difference between Reformist and Progressive:

Well, what brings people together is not ideology. There are progressive as well as moderates, McCain Republicans, Greens, and even some evangelicals. They are united because they all feel the need for change. The evangelicals are attracted because they see the hypocrisy of the pro-life people who are pro-life only until the child is born. They don't accept some of the teachings. They are against gay-bashing. We have a powerful moral attraction, because we care about the lesser among us ... our movement empowers those people who have been left out, the young people who have been left out. We are all fighting the fact that religious bigotry is back in favor, encouraged by the president. Our organizations encourage a lot of different kinds of people. We show respect for differences.

Feels good, doesn't it?

Who said that? Yep. Howard Dean.

Social Security Graph

I try to keep track of the social security stuff, but it's pretty complicated and I'm not completely sure what they are suggesting. Here's my attempt of a graph at what is happening with Bush's proposal compared to what it is now. Does this seem about right?

From what I understand, only the yellow cloud funds seniors.

January 04, 2005

More Ohio Statistical Abuse

In Ohio's Cuyahoga County, you have 1436 precincts.

203 total precincts with ballot spoilage > 3%, or 14.1%

218 total precincts with blacks > 80%, or 15.2%

Call these black precincts.

100 total black precincts with spoilage > 3% of ballots cast.

The conclusion that folks are drawing is that since, statistically, you'd expect only 31 black precincts to have a spoilage rate of above 3%, this is proof of discrimination.

Why is this not necessarily a good conclusion?

Doo doo doo doo doo.

Because of the size of precincts. You'd expect larger precincts to have a higher error rate just because of population density. Black precincts are almost always larger precincts. What you'd have to do is compare black precincts with nonblack precincts of similar density or size. If the error rates were the same, then you could have all the results above and still have it not be discrimination. If they were different, you'd have the evidence of discrimination.

Update: It is true that precincts tend to be around the same size. But they do vary, and there are probably other correlations along these lines to control for as well, before you can stake out a conclusion like this.

Gay Marriage Redux

For all the intelligence and scholarly thought on the left, there's a lot of chickenshitism.

I've twice brought up my thoughts regarding gay marriage in online progressive discussion forums, and both times gotten serious resistance from people.

Now, I'm okay with getting resistance to my ideas if I feel like they are being fully accepted and then responded against with some other information that I haven't thought of.

But far too often, the kind of responses that a big idea gets are the kind that only half-swallow the suggestion, and then ward the rest of it off with a wall.

My main point regarding gay marriage is that while arguing in favor of it, referring to it in terms of "protection of our right to marry" is a bunch of garbage.

What I advocate is a more head-on defense of gay marriage. That gays haven't been able to marry each other, and that they deserve to be able to marry each other. That allowing gays to marry is an expansion of rights as far as society is concerned. It is a new step forward in societal tolerance, and needs to be acknowledged and dealt with in a head-on manner.

What I dislike are the so-called "framing" techniques that try to convince heterosexuals that if they don't vote yes on gay marriage, that their ability to marry is somehow degraded. That if they want to protect the institution of marriage, they have to vote yes. That if we don't allow gays to marry, then we have less freedom to marry than we used to. (It's surprising how many people try to pass that one off.) It's ridiculous.

We are not going to get far at all by trying to appeal to Joe Heterosexual's self-interest. This is not about the self-interest of straight people. It's about recognizing that gays should have the right to marry.

Some folks tried to make the point that of course it's about "freedom to marry", just like how allowing women to vote was about "freedom to vote", and how allowing blacks to vote was about "freedom to vote", and so doesn't that mean that I would be against arguing for the freedom to vote on behalf of women and blacks?

That's exactly what I mean in terms of being so scared of dealing with it head on that they will wriggle around and try to not even see my point. No, of course that representation of my point is not correct. My point is that when women were given the right to vote, the debate was specifically about allowing WOMEN to vote. It wasn't about convincing MEN that their right to vote would somehow be threatened. Same with black civil rights.

There is a lot of worrying and shame about homosexuality among the left. That's what I mean about chickenshitism. The main argument in favor of allowing blacks to vote was hardly, "It's not his fault that he's black. He can't help it that he's black. He didn't make the decision to be black. We can't hold it against him that he's black. So we should let him vote like everyone else!" I mean, honestly. That's repugnant. Too many people on the left are trying to find any way possible to not talk about homosexuality. They hear a point about advocating a more head-on defense, get scared that there won't be oxygen about it, and instead of getting busy to create the oxygen, they come up with tortured academic explanations about why the truth won't fly. This debate is about bigotry, and it's bigotry that needs to be dealt with head-on. Until we get over our shame and embarrassment about our dirty gay siblings in the back closet, we'll be fighting a losing battle.

Cocoa Software Wishlist

I want:

- A Cocoa-powered desktop wiki like VoodooPad, but with revision history for each page, so I can make a diff between revisions (preferably a really cool diff like Xcode has).

- An outliner sort of thing where I can drag in a bunch of files as aliases, assign a bunch of metadata tags to them, and then create smart folders of them. I just have way too many uncategorized folders and hierarchical thinking doesn't work for me.

- A better todo list application that doesn't lock me into hierarchical thinking. I'm actually working on writing this one. It'll be cool.

- Online issue trackers like mantis should have desktop counterparts. I'd like one of those, too.

January 03, 2005

OS X Desktop Utilities

Well, I finally dumped DragThing. What a relief! I played a bit with QuickSilver, and didn't like it. What I liked about dragthing was that the launcher I had set up - applications put in categories - also helped serve as a visual reminder to launch some apps occasionally that I wouldn't have thought to launch through remembering to type an abbreviation. Like Quicken. If I had to just randomly remember, I'd never start the damn thing.

So, I'm using Butler. I have a docklet that just has five items - Volumes, and four iTunes smart items (song info, skip back, play/pause, and skip forward). And then on top of that, I created a container that contains other containers, called "Launcher", where I recreated all my favorite app categories. I've got it as a hot corner in the upper left, and I also have option-command-L bound to bring it up in the center of the screen.

I nuked DragThing, and put my dock back on the bottom of my screen. Ahh. Much cleaner now.